Quantitative Research Roadmap - How to Become a Quant Researcher

In this article, we will take you through the education, qualifications, and experience that will maximize your chances of breaking into quantitative finance as a researcher.

Introduction

Quantitative research is a very intellectually stimulating career choice. As a quantitative researcher, you will apply mathematics, statistics, and finance knowledge to the limits, as you explore and discover new strategies and correlations that directly impact the health of global financial markets.

In this roadmap, we will guide you through the key steps to optimise your chances of breaking into quantitative research, including relevant education, technical and behavioural skills, research projects, and tips for acing interviews. Whether you're just beginning your quantitative journey, or looking to sharpen your skills, this article will provide a clear path to kickstarting a successful career in the field!

What is Quantitative Research?

Put simply, quantitative research is the art of transforming raw numbers, derived from assets, derivatives, and real-life metrics, into statistical correlations. This is achieved by uncovering patterns, correlations, and relationships, and fitting them to distributions.

Quant researchers typically work on large-scale projects over multiple months, to find underlying trends in complex data. These trends can then be translated into trading strategies, aiming for optimisation to ensure pricing engines and libraries are efficient and accurate.

Education

Quantitative research roles require at the minimum a bachelor's degree, with most programs specifically requiring a master's or PhD. The field of focus is typically STEM, venturing deep into any given mathematical, statistical, physical, or any other technical domain.

As a quantitative researcher, you will have to have a very strong grasp of math, statistics, software engineering, data analysis, and applied research, making a master's or PhD certification very appealing.

Do you need a postgraduate degree for research?

No, there are a few opportunities that allow you to have just a bachelor's for quantitative research, but you will likely need to have deep independent research experience, outside of your degree. However, you will be restricted in your ability to apply to certain firms, since some roles have specific prerequisites regarding master's and/or PhD's.

Technical Skills

As a quantitative researcher, you must possess key skills that allow you and fellow researcher to inspire creativity and innovation from a quantitative perspective. As such, the most important skills for quantitative research include:

Math and statistics

YIt is very important to be an expert in advanced math and statistics, since you will be spending a lot of time modelling and forecasting, using statistics as a launchpad for discovering potential trading strategies.

Creativity and Innovation

Being able to create innovative solutions through thorough mathematical and statistical analysis is essential.

Programming and machine learning

Machine learning enables the development of sophisticated trading algorithms and the analysis of vast datasets to identify profitable opportunities.

Data analysis

Being able to utilise time-series analysis and other forms of data analysis to find trends and mathematical relationships is key.

Logic and Problem Solving

You can use logic and reasoning to come up with clever solutions in a research setting. You also like challenges and puzzles - and you feel excitement when finding optimal solutions to problems.

Behavioural Skills

An overlooked component of breaking into quantitative finance is the sociable aspect. The most important soft skills you will need for a career in quantitative finance include:

Communication and Collaboration

You should have a strong ability to communicate your thoughts clearly and concisely to your coworkers. You should enjoy working in a team, looking to solve problems in a collective and collaborative way.

Innovation and Adaptability

The ability to pivot and refine strategies, models, and approaches in response to new data, emerging technologies, or market shifts. You must combine creativity and analytical thinking to adjust to evolving market conditions and adapt to new events.

Management skills

Possessing the ability to manage workload, dedicate adequate time to projects, and balance priorities is essential.

Experience

Gaining experience in quantitative finance while studying is very challenging, and often non-existent. The best ways you can further learn by doing in the quantitative industry before applying to internships/graduate positions is by going to the pre-penultimate programs, working on quantitative projects, and doing competitions.

- If you are in a master's or PhD program, the thesis that you complete will be satisfactory for a quantitative research role. However, if you are a bachelor's student, it is wise that you complete a project outside of your degree. View our project ideas to prosper in quantitative finance.

Online Assessments and Interviews

Learning how to interview with quantitative firms, and understanding what questions appear in interviews, is crucial. You don't get much time in an interview to demonstrate your abilities - so it is essential you learn how to make a good impression!

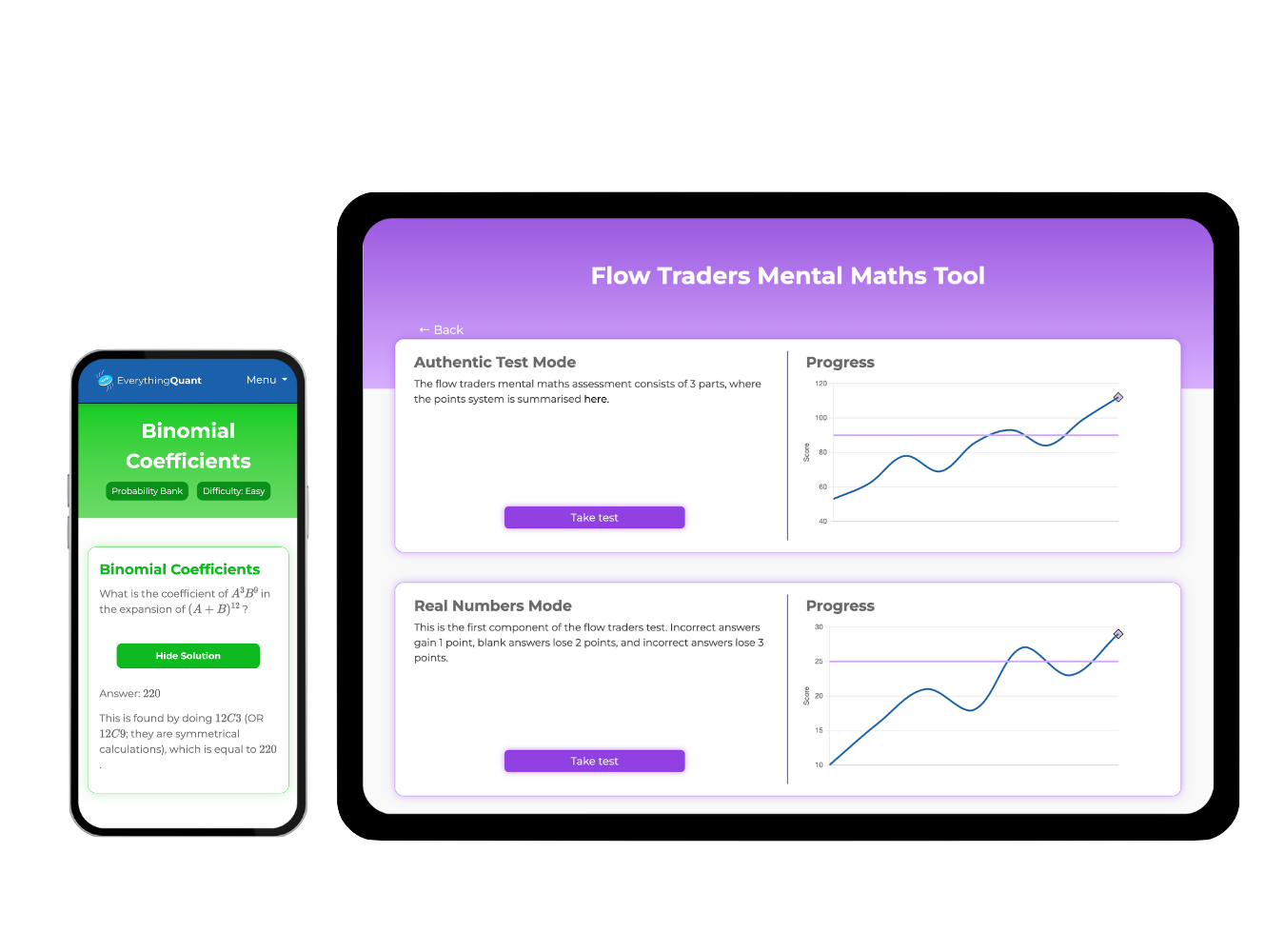

At EverythingQuant, we have a range of interview guides, online assessment simulations, interview questions, and interview prep courses. By using our interview preparation resources, you can highly boost your chances of landing a quantitative research role and kickstart your career.

Closing Remarks

Quantitative finance is a very competitive industry. To gain an advantage in the interview process, we recommend that you start preparing early and stay consistent in your preparation. Many applicants fail to delegate adequate time for interview preparation, or overlook interview preparation in general, leading to failing throughout the interview process.

For any competitive job, interviewing is a must-have skill. To stand out, and maximise your chances of securing your dream position, you must prepare early.

For additional resources for quant interviews, view our Probability for Quant Finance course, along with 200+ high quality brainteasers and probability interview questions for technical interviews.